Operating

Performance

Review

Operating

Activity

In accordance with the law of Kazakhstan “On Electric Power Industry”, KEGOC as the System Operator shall ensure non-discriminatory access to the electricity market for all market players. The connection to the national power grid shall be provided in accordance with the Grid Code and Rules of Electricity Usage. KEGOC grants equal access to the NPG for all wholesale electricity market participants.

More details on how to access the national power grid is available at “Company – Activity – Procedure for the access to the National Power Grid” section of the company’s website.

The consumers of KEGOC services are legal entities: energy-producing, energy transfer, energy supplying organizations, and industrial enterprises.

In 2020 KEGOC delivered all its contracted and requested system services to the wholesale market entities. The total number of service contracts and agreements continued after 2019 and concluded in 2020 was 861.

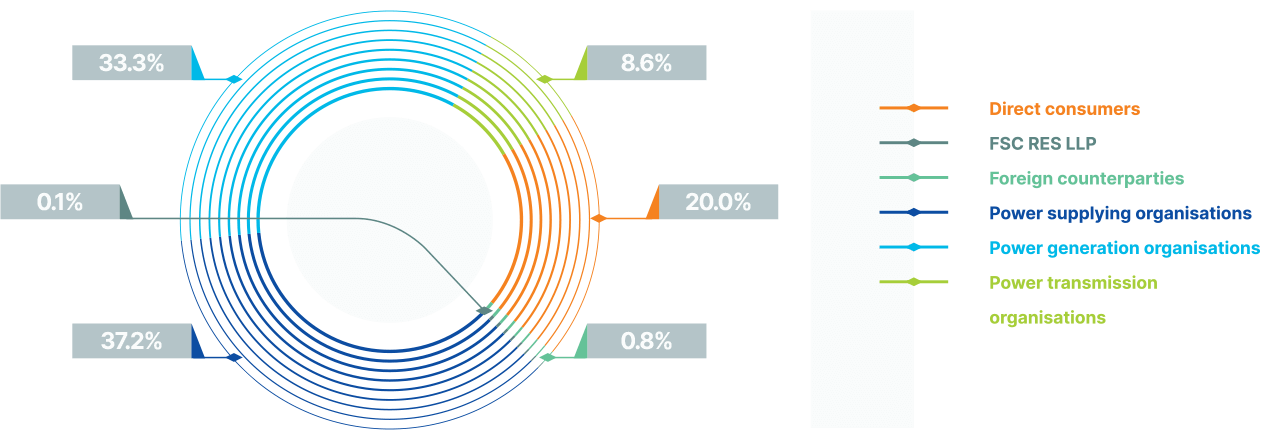

Contract consumer categories

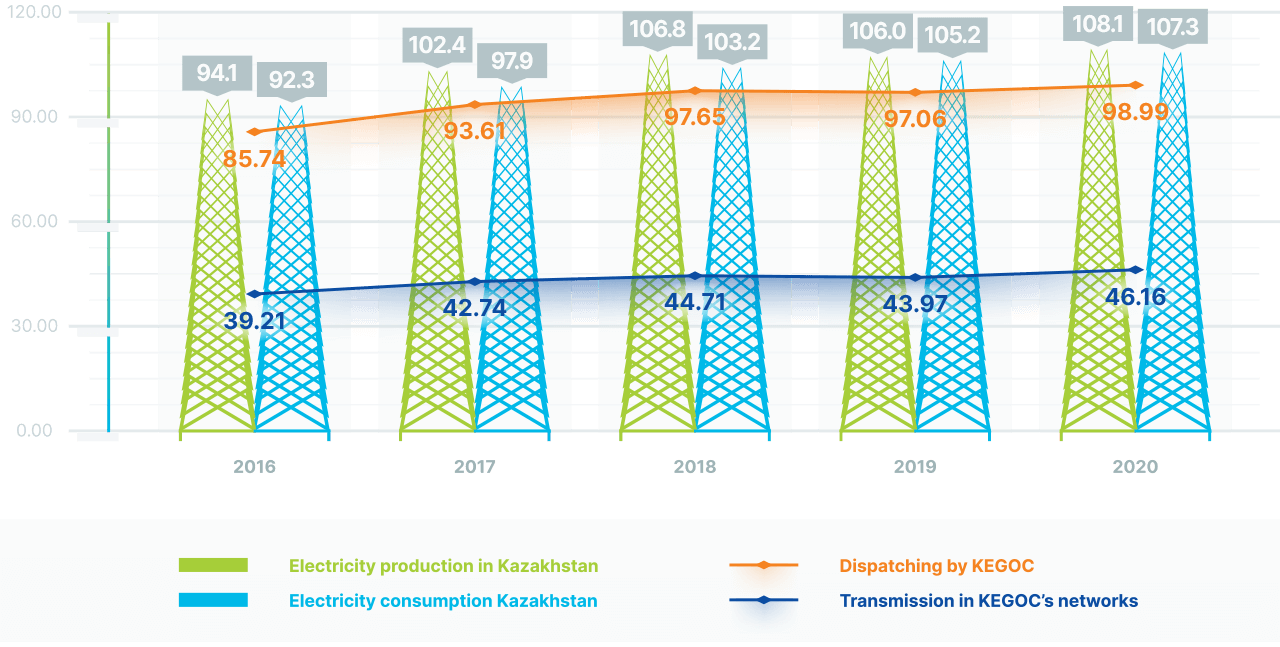

KEGOC in the industry, billion kWh

Electricity Transmission

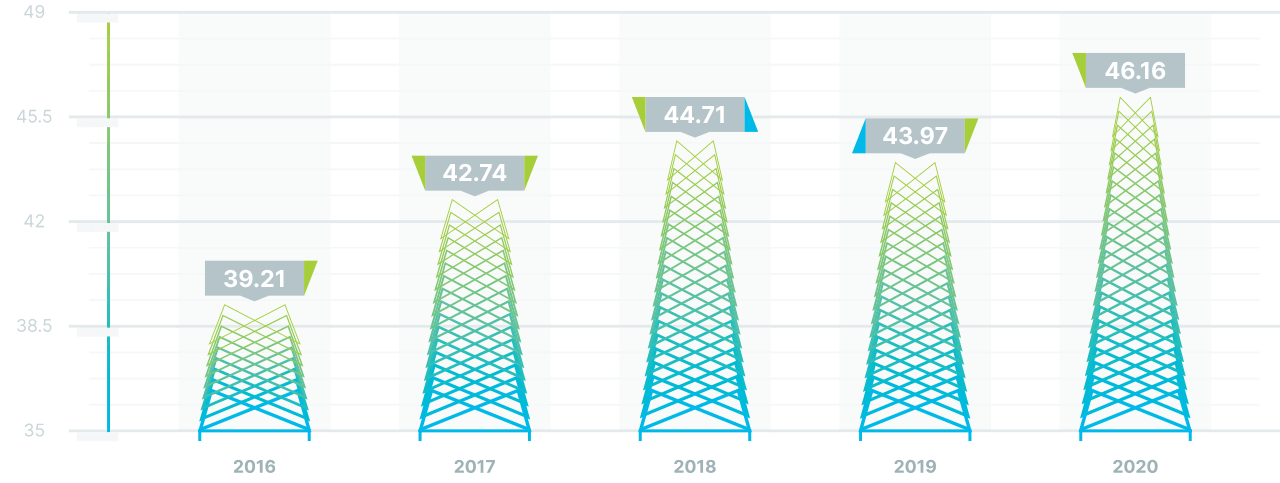

Electricity transmission in KEGOC’s networks, billion kWh

The actual amount of the transmission services in the national power grid in 2020 amounted to 46.16 billion kWh, which is higher than in 2019 by 2.19 billion kWh or 5.0%. The main reasons for the increase are:

- the increase in electric power transmission to wholesale market participants in Kazakhstan by 1.45 billion kWh or 3.7% vs. the same in 2019.

- the increase of 0.21 billion kWh, or 21.8%, in electricity exports under the Company’s contracts compared to 2019;

- the increase in the amount of electricity transmission through KEGOC’s grids of interstate power flow on route of the Russian Federation – the Republic of Kazakhstan – the Russian Federation by 0.53 billion kWh or 14.8% than in 2019 (4.1 billion kWh in 2020, 3.57 billion kWh in 2019).

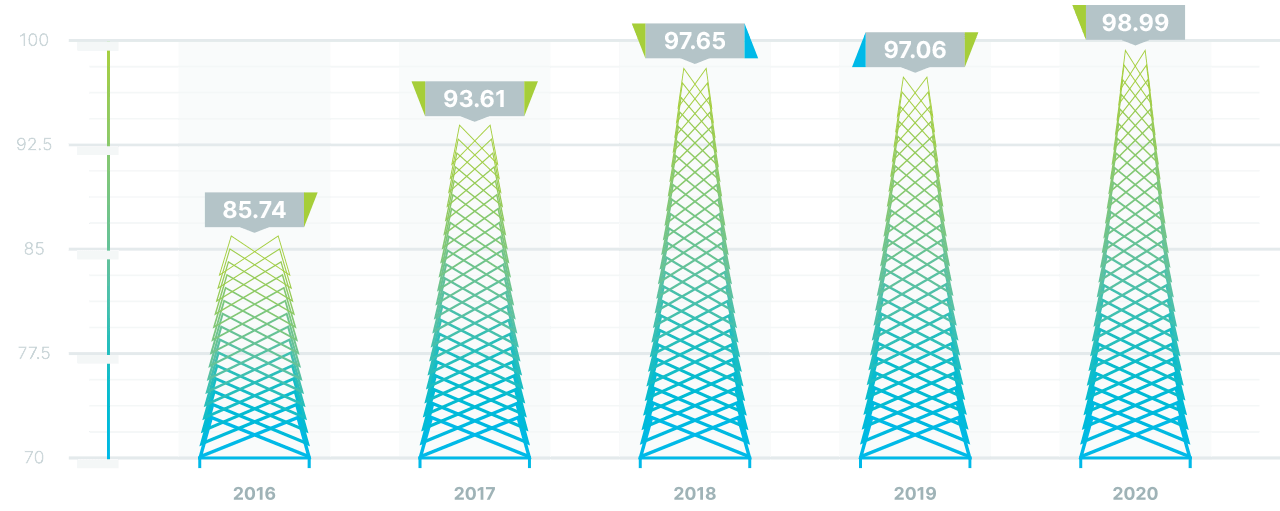

Technical Dispatching

Technical Dispatching, billion kWh

The actual amount of technical dispatching of supply and consumption of electric power in the grid in 2020 was 98.99 billion kWh, which is 1.93 billion kWh or 2.0% higher than in 2019 and is attributed to an increase in electric power generation by power generating organisations of the Republic of Kazakhstan.

Management of electricity production and consumption balancing

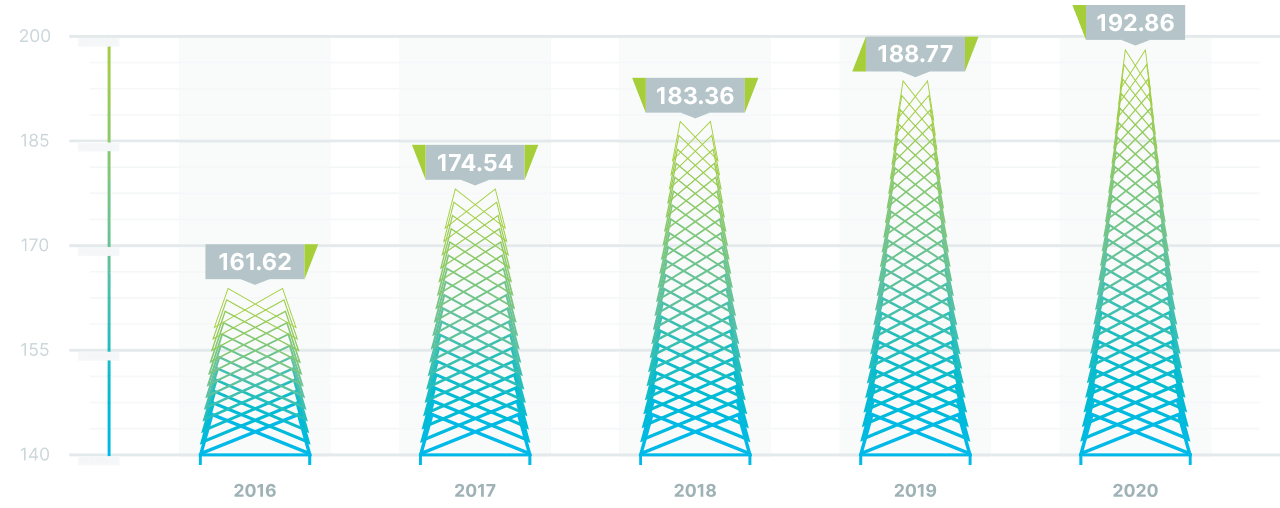

Electricity production and consumption balancing, billion kWh

The actual volume of electricity generation-consumption balancing services in 2020 was 192.86 billion kWh, which is 4.08 billion kWh or 2.2% higher than in 2019, due to an increase in electricity consumption in the wholesale market of the Republic of Kazakhstan.

Renewable Energy Development

Following the international trends in low-carbon development, in May 2013, Kazakhstan adopted a Concept of Transition to a “Green Economy” with an ambitious target: by 2050, 50% of the generation should be from alternative or renewable energy sources. E.g. according to the Concept of Transition to a “Green Economy” and the Strategic Development Plan of the Republic of Kazakhstan till 2025, the share of renewables in total electricity generation should be 3% by 2020, 6% by 2025, 10% by 2030 and 50% (alternative + renewables) in 2050.

To this end and to meet the requirements of the law, KEGOC established a subsidiary, FSC RES LLP, that has been successfully operating in the RES and power market. The RES laws are being regularly perfected, and through that process KEGOC has initiated an auction system of RES bidding, which has proven to be effective. RES energy enjoys a priority dispatch, and 100% of electricity produced by RES facilities is supplied to the Unified Energy System and paid for.

The ongoing studies are looking for the way to better predict RES generation and show the potential to reduce the unscheduled deviations of RES generation, which will reduce the amount of reserves needed in the power system. A study of simulated energy system is carried out using PLEXOS and DigSilent software, which assesses the impact of renewables on the energy system and the optimum locations and amounts of renewables based on the existing grid capacity.

In 2021, studies will be carried out on energy storage systems, a review of technologies and their costs, and the potential use of storage in the energy system.

At the end of 2020, 116 RES facilities with a total installed capacity of 1,685 MW were in operation in Kazakhstan.

In 2020 they generated 3.24 billion kWh, or 3% of Kazakhstan’s total electricity generation. It is 74% higher than RES electricity generation in 2019. In terms of number of RES facilities by technology, HPPs and PV dominate. The largest number of power plants are located in Almaty, Turkestan and Zhambyl oblasts. At the same time, according to the Ministry of Energy of the Republic of Kazakhstan, 96% of all RES electricity is concentrated in four oblasts of Kazakhstan - Almaty, Zhambyl, East Kazakhstan and Turkestan.

The centralised purchase and sale of RES electricity is based on concluded contracts with RES energy producing organisations and convention-based consumers according to standard forms approved by the Ministry of Energy of the Republic of Kazakhstan.

As of 31 December 2020, FSC RES LLP has entered into 131 contracts for a total installed capacity of 2,811 MW, including: 86 fixed tariff contracts, with a total installed capacity of 1,800 MW; 45 auction-price contracts, with an installed capacity of 1,011 MW. At the end of 2020, the number of operating RES plants selling electricity through RFC RES LLP amounted to 72 units with a total installed capacity of 1,570 MW.

Network Reliability

The power industry in the Republic of Kazakhstan is of great importance, as the key national industries such as metallurgy and oil and gas production are highly energy intensive industries. Accordingly, the competitiveness of the production industries in Kazakhstan and the living standards are highly dependent on the reliability and quality of energy supply to consumers.

In 2020, 248 emergency outages occurred in KEGOC’s electricity networks (which is 17% higher than in 2019): in 137 cases the stable network operation was preserved by the successful autoreclosing, and in 111 cases the autoreclosing was unsuccessful.

In 2020, the Company recorded and investigated 48 operational disturbances, including 1 major failure, 2 failures of Class I, and 45 failures of Class II. This indicator grew by 14% compared to 2019.

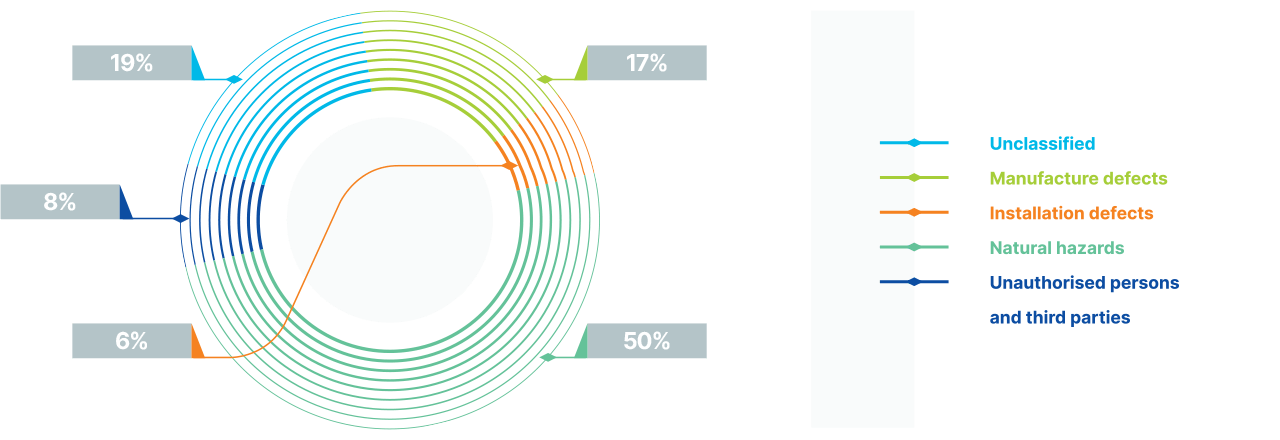

Breakdown of technical disturbances by class

There were 34 technical disturbances on power lines in 2020. Out of the total number of operational disturbances on overhead lines, 15 have damaged the elements of the overhead line.

There were 14 operational disturbances at the substations in 2020. Of the total number of operational disturbances at the substation 6 have damaged the main equipment.

The following sectoral indices are used internationally to evaluate the network reliability performance:

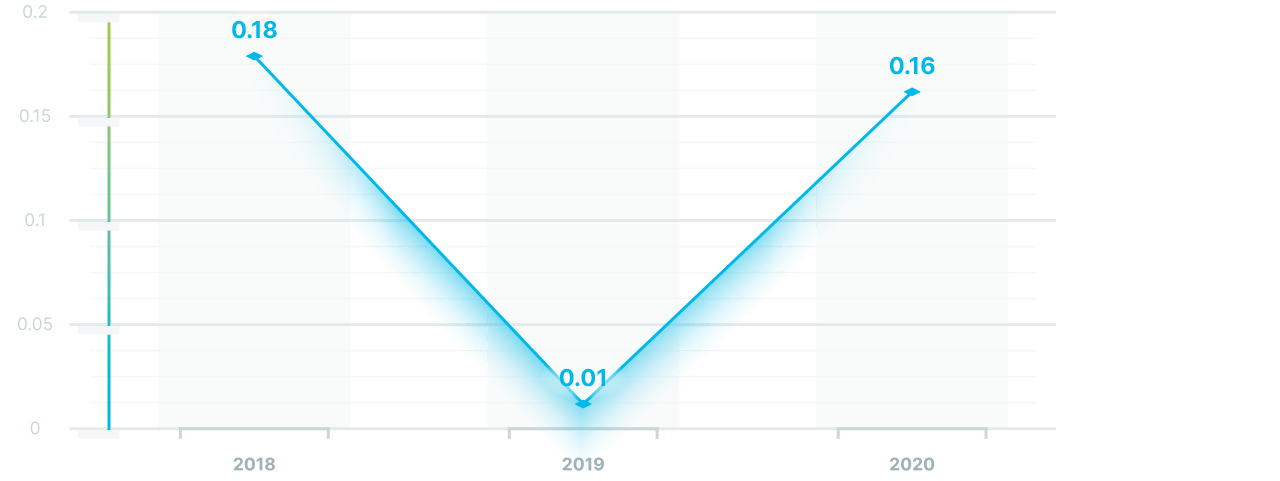

SAIDI – System Average Interruption Duration Index – describes the average one interruption duration per year in minutes.

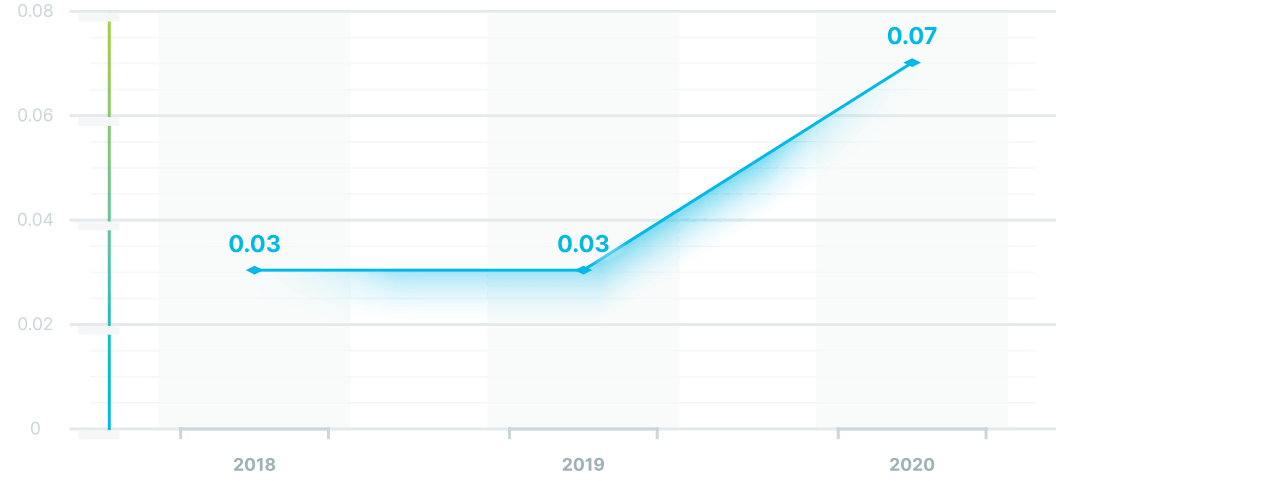

SAIFI – System Average Interruption Frequency Index – is the average interruption frequency.

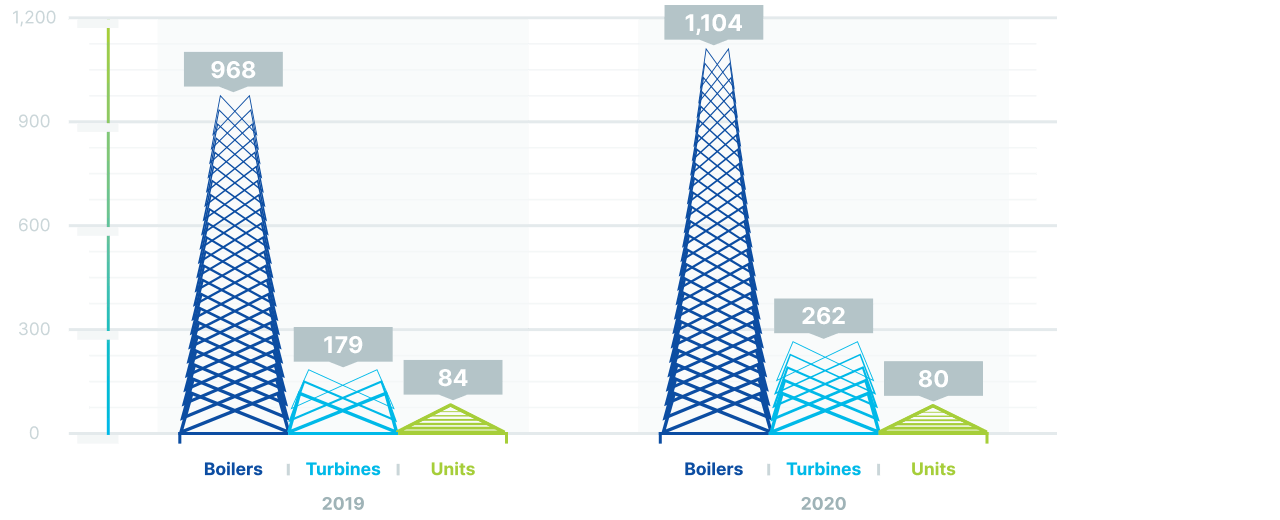

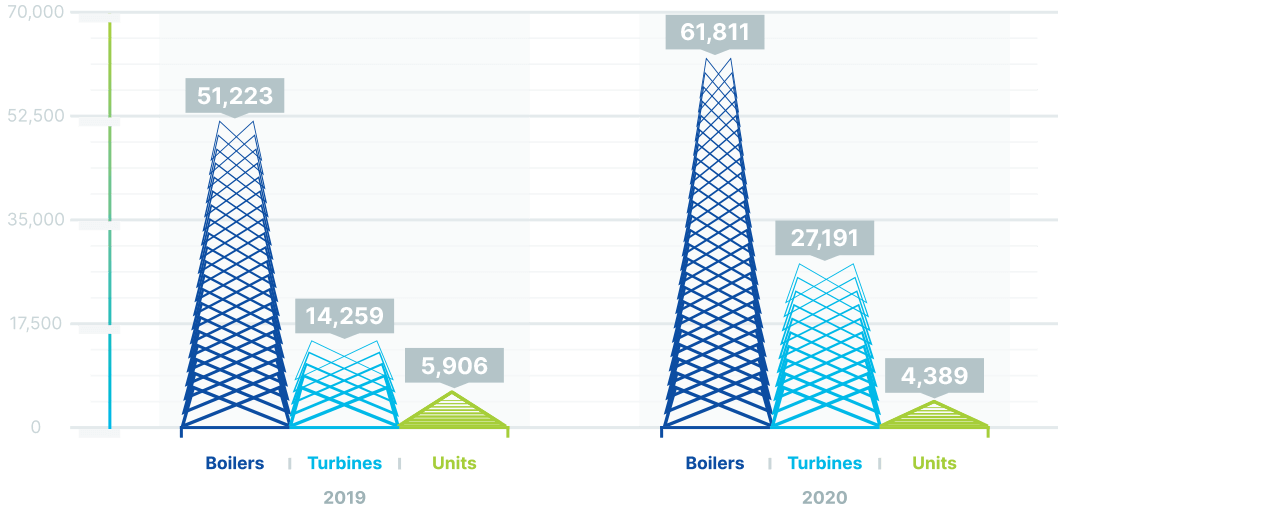

In 2020, the number of TPP boiler emergency shutdowns was 1,104 with the total duration of 61,811 hours as compared to 968 shutdowns for 51,223 hours in 2019.

The number the turbine emergency stops in 2020 was 262 with total duration of 27,191 hours as compared to 179 emergency stops and 14,259 hours in 2019.

Power units had 80 emergency shutdowns in 2020 for 4,389 hours as compared to 84 emergency shutdowns for 5,906 hours in 2019.

The emergency shutdowns of generating equipment significantly reduce the reliability of the UPS of Kazakhstan and lead to congestions that have to be addressed by the System Operator to prevent emergencies in the UPS of the Republic of Kazakhstan.

The company’s development strategy uses SML and WWP indicators to assess the network reliability. SML, the quality indicator, showed 5.21 minutes and the WWP showed 98.63% for 2020.

The worse performance is attributed to higher amount of energy not supplied and the emergency load shedding: the total energy not supplied in 2020 was 1368.87 thousand kWh vs 132.10 thousand kWh in 2019. Of the total energy not supplied in 2020 (1,368.87 MWh) 90% (1,226.85 MWh) is due to technical failures caused by:

- natural emergency at Sarbaiskiye MES branch on 7 April 2020 (793.95 MWh or 58% of the total energy not supplied);

- North-South Transit Line shutdowns due to capacity shortages in Zone South of the Republic of Kazakhstan (432.9 MWh or 32% of the total energy not supplied).

Thus, less the amount of energy not supplied that occurred due to the above-mentioned reasons (beyond control of the Company), the energy not supplied in 2020 amounted to 142.02 MWh, with SML of 0.54 minutes.

Duration of emergency shutdowns in 2020 compared to 2019

Number of emergency shutdowns in 2020 compared to 2019, hours

Tariff Policy

The operations of KEGOC are regulated by the law of Kazakhstan “On Natural Monopolies”, which describes the services provided by KEGOC as the natural monopoly services, including:

- electricity transmission in the NPG;

- technical dispatching of the electricity supply and consumption in the grid;

- electricity generation and consumption balancing.

Once established, KEGOC has been consistently improving the tariff policy of regulated services and playing an active role in activities of relevant organisations to improve the tariff policy.

In accordance with the legislation of Kazakhstan, to approve (revise) its regulated natural monopoly service tariffs, KEGOC shall submit applications to the Committee for the Regulation of Natural Monopolies.

The Company’s tariffs are set on a costs-plus basis, whereby the Company, in order to set a tariff for a certain period of time, considers the corresponding estimates of operating and financial costs and a fair rate of return on capital.

In 2013, KEGOC switched to the regulated cap tariffs mechanism. The principles of the cap tariff estimation are similar to the estimation of the annual tariffs except that the cap tariffs shall be approved for a period of several consecutive years. The cap tariffs enable the Company to plan its capacity for long periods, and shareholders have the opportunity to get more information about the Company.

In accordance with the existing procedures KEGOC applied to the Committee on Regulation of Natural Monopolies (CRNM) for approval of the long-term cap tariffs and tariff estimates for regulated services. The Committee approved the cap tariffs and tariff estimates for KEGOC’s regulated services for a five-year period from 01 January 2016 to 31 December 2020.

| KZT/kWh | 2016 | 2017 | 2018* | 2019** | 2020 |

|---|---|---|---|---|---|

| Electricity transmission | 2.080 | 2.246 | 2.496 | 2.496 | 2.797 |

| Technical dispatching of the electricity supply and consumption in the grid | 0.231 | 0.234 | 0.237 | 0.237 | 0.306 |

| Electricity generation and consumption balancing | 0.084 | 0.086 | 0.088 | 0.088 | 0.098 |

* Effective from 1 August to 31 December 2018, KEGOC upon approval of the Committee, reduced the cap tariffs: by 5% from 0.2482 to 0.237 KZT / kWh for technical dispatching, and by 3.4% from 0.091 to 0.088 KZT / kWh for balancing of electricity generation and consumption.

** Given the decision to reduce the cost of electricity the Ministry of Energy of Kazakhstan, as well as the growth trend of the regulated services rendered by the Company, KEGOC, upon approval of the Committee, decided to reduce its cap tariffs to 2018 level starting 1 January 2019.

In 2020 the cap tariffs for regulated services of KEGOC expired, and, in accordance with the requirements of the natural monopoly legislative acts, in July 2020 the Company submitted to the CRNM an application for approval of the cap tariffs and tariff estimates for the next five-year period (2021-2025). The consideration is in progress.

The Company annually arranges the reporting events to present the company performance in delivering services (goods, works). The events are intended to protect consumers’ rights, ensure transparency of activities for consumers, and other stakeholders. The main principles of conducting the annual reporting hearings are to ensure publicity and transparency of the Company’s activities and preserve the balance of consumer interests.

Analysis of Financial

and Economic Indicators

Plan/actual analysis

| KZT million | 2020 / plan | 2020 / actual | Deviation | Main reasons for deviations |

|---|---|---|---|---|

| Consolidated income | 348,730.6 | 375,574.5 | +7.7% | |

| operating income | 341,566.3 | 350,659.5 | +2.7% | The increase is mainly due to an increase in: income from electricity transmission, due to the compensating tariff effectiveness dates changed by the authorised body; income from sale of purchased electricity produced by renewable energy sources due to an increase in its actual amount; income from provision of services for electricity capacity availability to bear the load due to an increase in its actual amount. |

| Consolidated expenditures | 313,751.1 | 309,826.2 | -1.3% | |

| cost of sales | 280,571.1 | 267,056.9 | -4.8% | The decrease was mainly: in expenses for compensation of technical electricity losses due to a decrease in their amount and price of electricity purchase; expenses for the purchase of electricity from the energy system of the Russian Federation to compensate the imbalances; expenses for the purchase of services of maintaining availability of electric capacity (expenses of FSC RES LLP); as a result of the absence of unscheduled flows of electricity to Central Asia; expenses for the purchase of electricity to compensate for non-contractual consumption; expenses of capacity regulation provided by third parties due to the lack of contracts for capacity regulation; and other current costs. |

| general and administrative expenses | 10,180.6 | 8,309.7 | -8.6% | The decrease was mainly in information systems support costs, consulting and professional services and other administrative costs. |

| sales expense | 381.9 | 364.1 | -4.7 | The decrease is mainly the result of cost optimisation. |

| Operating profit | 50,432.6 | 74,909.6 | +48.3 | |

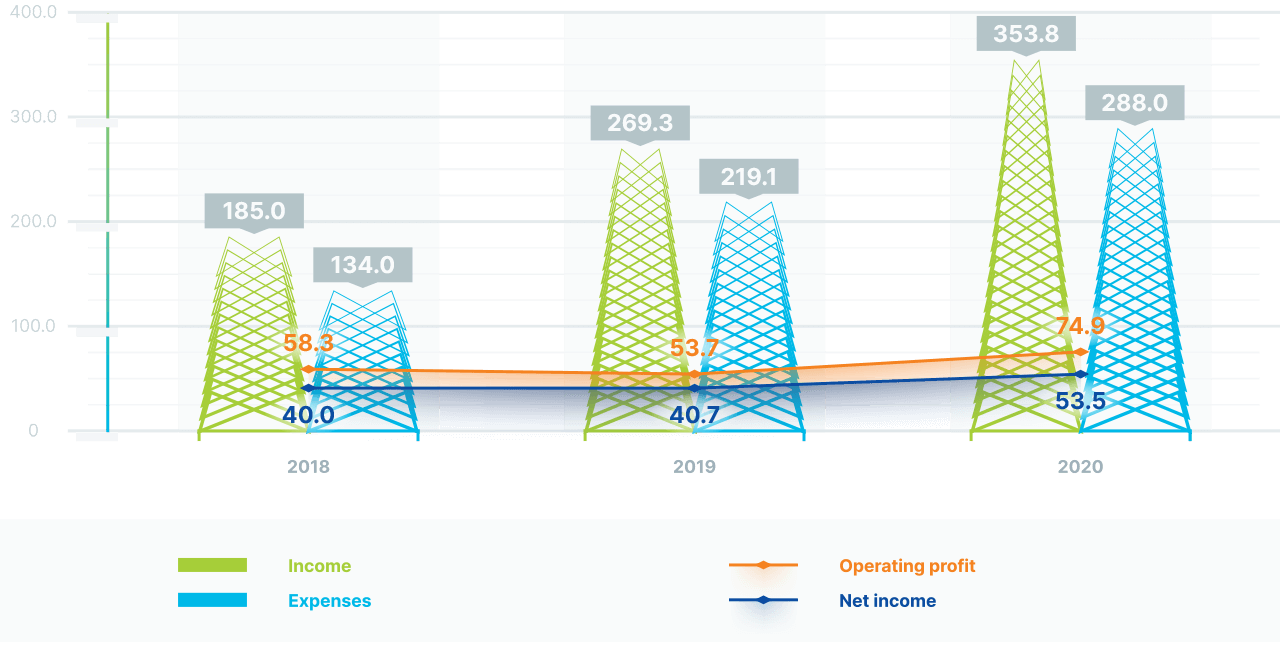

Financial and economic performance, KZT billion

Ratio Analysis

Key Indicators

| Indicator | 2018 / actual | 2019 / actual | 2020 / actual |

|---|---|---|---|

| Strategic KPI, Level 1 | |||

| ROACE, % | 7.16 | 7.47 | 9.48 |

| EBITDA, KZT million | 81,222 | 88,513 | 108,437 |

| Loan agreement covenants | |||

| Current liquidity ratio (not less than 1) | 1.25 | 2.19 | 1.69 |

| Covenants set by Samruk-Kazyna | |||

| Debt/EBITDA (not more than 3.50) | 2.00 | 1.70 | 1.49 |

| Debt/Capital (not more than 1.00) | 0.34 | 0.31 | 0.32 |

During 2020, the established financial stability indicators and covenants were not violated.

Direct Economic Value Generated and Distributed

The economic component of KEGOC’s operations is strategically important both for the Company and for the economy of the state. It is aimed at increasing the long-term value for shareholders and investors of KEGOC.

Procedures for formation and approval of the Business Plan and Budgets (including the capital investment plan for implementation of investment projects for construction, rehabilitation and modernization of the Company’s facilities) are regulated by the Rules for development, coordination, approval, amendment, execution and monitoring of execution of the Business Plan (Development Plan) and Budgets of KEGOC. The Business Plan is developed on a consolidated basis, i.e., including the plans of the subsidiaries, for a 5-year period on a rolling basis. An annual budget shall be approved for the Business Plan implementation. The Business Plan shall be monitored by KEGOC’s Board of Directors on a quarterly basis.

Economic value distribution

| KZT million | 2018 | 2019 | 2020 |

|---|---|---|---|

| Total capitalization | 634,752.89 | 632,163.54 | 663,590.50 |

| equity capital | 472,693.80 | 481,838.02 | 502,556.47 |

| borrowed funds | 162,059.09 | 150,325.52 | 161,034.03 |

| Funds from the government | 0 | 0 | 0 |

| Economic value generated | 185,017.94 | 269,329.57 | 359,075.67 |

| operating income | 175,797.39 | 263,162.07 | 350,659.55 |

| financial revenue | 4,951.34 | 4,171.53 | 7,146.01 |

| other income | 4,269.22 | 1,995.96 | 1,270.11 |

| Distributed economic value: | 176,346.50 | 260,222.43 | 338,357.22 |

| payroll expenses | 21,048.03 | 22,699.12 | 23,977.19 |

| expenditure on taxes and levies to the state budget | 18,553.89 | 19,110.84 | 21,591.03 |

| payments to providers of capital | 35,233.94 | 40,842.53 | 43,952,81 |

| charitable and sponsorship assistance | 0 | 0 | 0 |

| other operating expenses | 92,442.60 | 177,185.20 | 242,445.47 |

| other non-operating costs | 9,068.04 | 384.74 | 6,390.73 |

| Economic value for distribution | 8,671.44 | 9,107.14 | 20,718.45 |

Balance Analysis

| Indicator, KZT million | 2018 | 2019 | 2020 | 2020/2019, % |

|---|---|---|---|---|

| Non-current assets | 698,081.7 | 659,175.9 | 695,192.5 | 5.5 |

| Current assets | 57,769.0 | 97,111.0 | 116,820.1 | 20.3 |

| Total assets | 755,850.7 | 756,987.7 | 812,012.6 | 7.3 |

| Equity | 472,693.8 | 481,838.0 | 502,556.5 | 4.3 |

| Non-current liabilities | 236,958.6 | 230,808.2 | 239,766.9 | 3.9 |

| Current liabilities | 46,198.3 | 44,341.5 | 69,689.2 | 57.2 |

| Total equity and liabilities | 755,850.7 | 756,987.7 | 812,012.6 | 7.3 |

Assets of the Company as on 31 December 2020 amounted to KZT 812.01 billion and grew by 7.3% as compared to 2019. Non-current assets account for 86% of the balance sheet structure, most of which are represented by property, plant and equipment. At the end of the year, long-term assets increased by 5.5% (or by KZT 36.0 billion) and amounted to KZT 695.2 billion. The increase in long-term assets is mainly due to the acquisition of long-term financial instruments.

he short-term assets account for 14% of the balance sheet. In 2020, they increased by 20.3%, (or KZT 19.0 billion) to KZT 116.8 billion at the end of the year. The increase is due to an increase in trade receivables and short-term financial instruments..

The capital at the end of 2020 was KZT 502.6 billion, an increase of 4.3%, or KZT 20.7 billion as compared to 2019. The growth is associated with an increase in retained profit. The capital share in the balance sheet structure was 62%.

Liabilities stood at KZT 309.46 billion for the year and increased by 12.5%, or KZT 34.3 billion as compared to 2019. 77% of liabilities are long-term, and 23% are the short-term ones. The long-term liabilities include 21% of loans, 39% of bonds and 37% of deferred tax liabilities. Short-term liabilities represent 59% of trade and other payables.

© 2021 Kazakhstan Electricity

Grid Operating Company

(KEGOC)

If Information Contained

in the Annual Report is Used, the User is Required

to Reference the Actual Report.

All rights reserved.

59 Tauyelsizdik Ave.,

Nur-Sultan, Z00T2D0

Kazakhstan

Tel.: +7 (7172) 69 38 24, 69 02 43

Fax +7 (7172) 21 11 08

E-mail kegoc@kegoc.kz

www.kegoc.kz